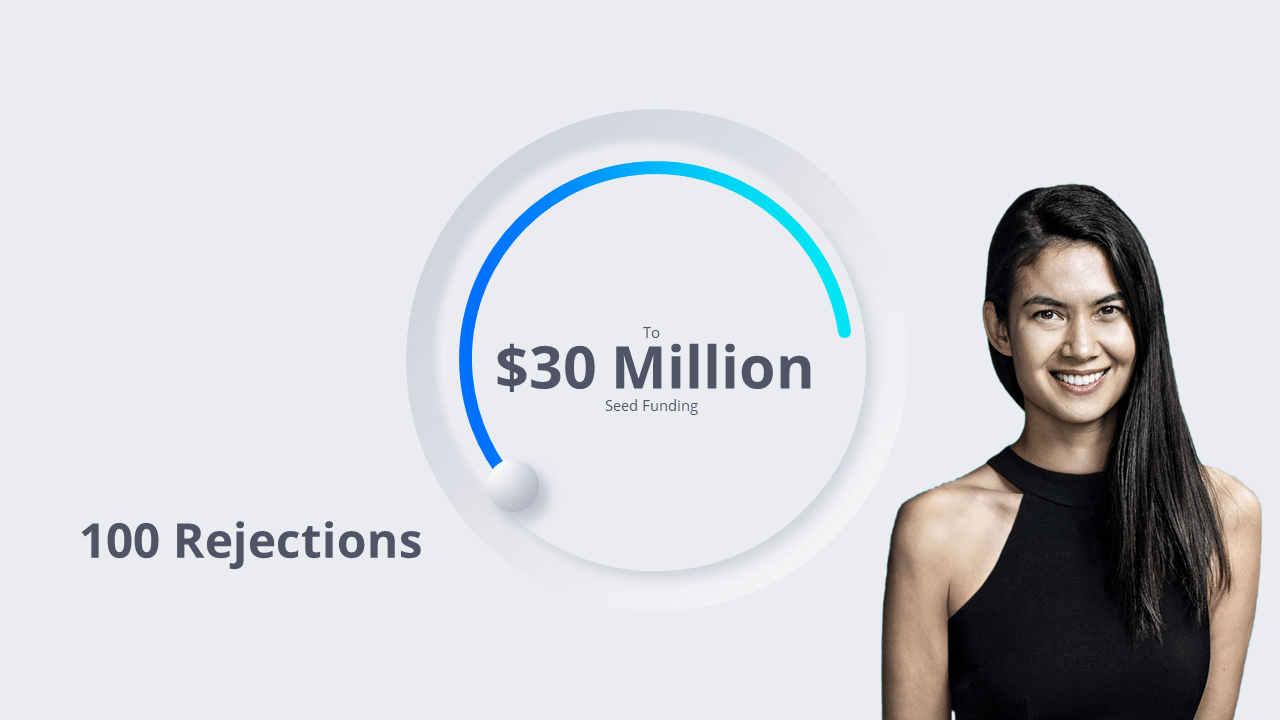

100 failed attempts of fundraising to 40B$ company.

Startup accelerators support early-stage, growth-oriented businesses with education, guidance, and money. Accelerators accept startups for a set period of time and as part of a cohort. The accelerator experience is a process of intensive, rapid, and immersive education aiming at compressing years of learning-by-doing into only a few months in order to reduce the life cycle of budding creative firms. Fixed-term, cohort-based, mentorship-driven, and culminating in a graduation or “demo day,” accelerators have four distinguishing qualities. Accelerators and these other organizations may have the same goal of supporting early-stage startups, but they are clearly distinct, with their own financing models and incentive structures.

Accelerator and incubator programs are the two most popular types of this type of collaboration. There is often a misunderstanding concerning the differences between the two. Let’s look at the structural differences first to see which program may provide you the most:

Accelerators may help your company grow in size and value in a short period of time, and they can also be a fantastic way to get your company into venture funding, especially if the founders are new to the startup ecosystem. Accelerators can assist early-stage companies in advance by providing: In addition to finance, which is the lifeblood of any business, accelerators can provide:

1. Y-combinator — Founded in March 2005, Y Combinator (YC) is a technology startup accelerator in the United States. Over 3,000 businesses have been launched as a result of it. The top YC firms had a combined valuation

of more than $300 billion by January 2021.

The company’s accelerator program began in Boston, then Mountain View relocated to San Francisco in 2019. Since the outbreak of COVID-19, the company has been totally online. Forbes

rated the organization one of the most successful startup accelerators in Silicon Valley in 2012.

2. 500 Startups — Dave McClure and Christine Tsai created 500 Startups in 2010 as an early-stage venture fund and seed accelerator. In February 2011, the fund accepted a first “class” of twelve startups into its Mountain View, California incubator. In June 2011, they added a second class of 21 students, and in October 2011, they added a third class of 34 students. As of February 2021, 500 Startups had invested in approximately 2,400 startups 500 Startups rebranded to 500 Global in September 2021 after closing a $140 million global flagship fund, the firm’s largest to date, bringing assets under management to $1.8 billion. The company has stated that it will broaden its investment strategy beyond the accelerator and seed stages. 500 Startups hosted their first totally virtual accelerator class in October 2021.

3. Techstars — In 2007, the business launched its first program in Boulder, with ten companies participating. Two of the 10 were purchased in the same year. Three had made a profit by 2012, and two were bringing in millions of dollars per year. Techstars expanded to Boston, Seattle, New York City, a “cloud” program in San Antonio, and Austin in future years. Startups can apply to Techstars, and their viability is assessed by the program’s managing director, as well as a screening committee comprised of various members of the Techstars network.

4 .Disney Accelerator — The Disney Accelerator was developed to help connect the latest tech with The Walt Disney Company. It assists technology innovators in achieving their visions for new media and entertainment experiences.

Early, growth, and late-stage venture-backed innovators with a vision for making an influence on the future of media and entertainment are eligible to apply for the company’s initiative.

Since its inception in 2014, the

Disney Accelerator has aided in the development of new ideas within The Walt Disney Company and has had a significant impact on the future of technology and entertainment. The eight firms selected for this year’s initiative are

all fantastic leaders in their respective industry sectors. Among other things, the Disney Accelerator gives participating startups with mentorship and support from top Disney leaders, as well as access to Disney co-working space.

Many of the firms that have participated in the Disney Accelerator since its inception have worked with multiple divisions of The Walt Disney Company to bring new goods and experiences to market

5. Global sports venture studio — Global Sports Venture Studio, a venture capital firm, was founded in 2015. The stated VC’s primary department is based in New York. The company was founded in the United States of America, in North America. In a number of portfolio company founders, the fund has no particular favorite. When a firm has only one or four founders, the chances of it receiving funding are slim. Furthermore, a firm must be at least 2–3 years old to get funding from the fund. Among the fund’s several public portfolio startups. The fund’s basic pattern is to invest in rounds with three to four participants. Despite the existence of the Global Sports Venture Studio, Social Starts, R/GA Ventures, and Vives Fund are frequently used to fund entrepreneurs. TACK Ventures, Elysian Park Ventures, and R/GA Ventures are important sponsors for the fund in the same round. Elysian Park Ventures, IrishAngels, and Ward. ventures typically acquire funds in subsequent rounds. The fund is always involved in two to six transactions every year. In 2015, fund activity was at its peak. Deals in the $1 million to $5 million areas are usual for funds.

6. Khosla Ventures — Vinod Khosla founded Khosla Ventures, an early-stage venture funding business focused on the Internet, computing, mobile, silicon technology, biotechnology, healthcare, and clean technology industries. Before starting his own fund, he worked for 18 years at venture capital company Kleiner Perkins Caufield & Byers (now known as Kleiner Perkins).

7. Sequoia — Sequoia Capital is an investment firm based in the United States, China, India, and Israel. The company works with businesses in a variety of industries and phases of development. Don Valentine established Sequoia in 1972. Don Valentine created Sequoia Capital in Menlo Park, California, in 1972, at a period when the state’s venture capital business was just getting started. Sequoia established its first venture capital fund in 1974, and the following year, it became an early investment in Atari. Sequoia was one of the early investors in Apple in 1978. In 1996, partners Doug Leone and Michael Moritz took over as the firm’s leaders. Sequoia started in October 2021 that it will introduce a new fund structure for its U.S. and European businesses that would allow it to stay associated with companies after they went public. Sequoia Capital is a limited-liability corporation (LLC). Limited partners donate money to a fund, which is then invested in commercial projects by the firm’s general partners. University endowments, philanthropic foundations, and other significant institutions have been Sequoia’s limited partners. Sequoia Capital is the umbrella brand for three venture firms: one focusing on the United States and Europe, another on India and Southeast Asia, and a third on China. Sequoia raised a $600 million Sequoia Crypto Fund in February 2022. The crypto fund, which is one of Sequoia Capital Fund’s first sub-funds, will primarily invest in cryptocurrencies traded on third-party exchanges.

8. Initialized — Garry Tan, a co-founder of venture fund Initialized Capital, became an investor almost by accident. Tan began working as a designer in residence at the famed startup accelerator Y Combinator in 2010, and later that year was given the opportunity to become an investor as the program evolved. Initialized, situated in San Francisco, has amassed an outstanding portfolio of unicorn startups — private companies valued at $1 billion or more — in the ten years since its creation. According to Crunchbase data, Initialized has 19 portfolio businesses that have since become unicorns, making it one of the most active early investors in potential $1 billion-plus startups. If you include Series A funding, the total number of firms rises to 23. Initialized has grown as a company since its inception when Tan was investing part-time from a $7 million fund. Its most recent core fund 6, which was raised in December 2021 for $530 million, was accompanied by a $170 million opportunity fund.

9. Plug and Play — Plug and Play Tech Center (or “Plug and Play”) is the world’s largest early-stage investor, accelerator, and corporate innovation platform, with headquarters in Silicon Valley’s Sunnyvale. Plug & Play provides two accelerator programs per year in each industry and region (for a total of 50 annual investments), and its ecosystem includes over 500 corporate partners and 200 venture capitalists. Silicon Valley Business Journal recently called it the ‘Most active Silicon Valley venture capital firm.’ Google, PayPal, Dropbox, LendingClub, N26, Soundhound, Honey, Kustomer, and Guardant Health were all early investors in Plug and Play.

10. Alchemist Accelerator —The Alchemist Accelerator is a venture-backed accelerator that focuses on seed-stage initiatives that generate revenue from businesses (not consumers). Based on median financing rates of its students, CB Insights named Alchemist the best accelerator in 2016 (YC was second). The primary screening criteria for the accelerator are centered on teams, with a focus on having different technical co-founders. Over the course of a six-month program, the organization gives initial funding to the startups it accepts (usually $36K), as well as a planned path to traction, fundraising, mentorship, and community for the entrepreneurs. Many of the Valley’s leading corporate and venture capital firms have backed Alchemist, including Khosla Ventures, DFJ, Cisco, Siemens, GE, and Salesforce, to name a few. Approximately 75 enterprise-monetizing businesses are seeded each year by the accelerator. The program offers a little cash investment in the form of a convertible note. Despite the fact that the program funds startups, it does charge a tuition fee, but it also gives additional cash in the form of a note to cover the fee.

11. SOSV —SOSV is a venture capital and investment management organization that invests in technology startups at the seed, venture, and growth stages. The company’s primary goal is to accelerate companies through market-specific seed accelerator programs in Europe, Asia, and the United States. SOSV is headquartered in Princeton, New Jersey, with offices in San Francisco, Shenzhen, Shanghai, Taipei, New York, Cork, and London, as well as operations in Cork, Ireland. SOSV is a venture capital firm that invests in hardware, software, consumer services, and life sciences. SOSV is a supporter of CoderDojo, a non-profit organization that teaches young people computer programming and technology. Every week, 10,000 children are taught to write computer code and programs in dojos in 22 nations.

12. Launchpad LA is a startup accelerator based in Los Angeles. It was formed in 2009 as a membership group by Mark Suster (GRP Partners) with the objective of assisting exceptional local entrepreneurs in building ties, obtaining funding, and growing while remaining in Southern California. It came up with the idea after becoming frustrated with watching companies in Los Angeles accept investment from Northern California VCs only to relocate their personnel. Indeed, Launchpad LA began as a true partnership among the area’s best VCs, with a common goal of seeing a thriving innovation community flourish in Los Angeles. The Launchpad LA team decided to raise capital, create an office, and evolve into a full-fledged accelerator in the model of TechStars or Y-Combinator, inspired by the growing market opportunity in LA and the success of Classes 1 and 2.

13. Rock Health —Rock Health is a full-service seed fund that supports digital health (also known as health technology) entrepreneurs. Rock Health provides its portfolio firms with cash, access to medical, venture, legal, and corporate partners, as well as office space. Rock Health partners include Fenwick & West, GE, Genentech, Harvard Medical School, Kaiser Permanente, Kleiner Perkins Caufield & Byers, Mayo Clinic, Mohr Davidow Ventures, and Montreux Equity Partners, Qualcomm Life, UnitedHealth Group, and UCSF.

14. Jumpstart Foundry —Jumpstart Foundry is a Nashville-based early-stage healthcare venture fund that invests in 15 to 20 healthcare technology firms each year. The business is looking for founders of firms in the healthcare technology field who are partially funded, running pilots, have gone through an accelerator, or have their first MVP. Jumpstart Foundry offers Founders more value than money can purchase.

15. Blue Startups —Henk Rogers, Maya Rogers, and Chenoa Farnsworth co-founded Blue Startups,a Hawaiian accelerator, in 2012. It was developed to assist beginning businesses and to promote Hawaii as a technical business hub. Over 120 mentors from Hawaii, Silicon Valley, and Asia are part of the company’s network. Henk Rogers, Robert Robinson, Steve Markowitz, Donavan Kealoha, Lisa Brett, Bill Spencer, Michael Troy, Joseph Pigato, and Eric Bjorndahl are among the eight lead mentors. The accelerator takes part in and organizes a variety of activities. Its most well-known event is its cohort program, in which the accelerator provides new companies with funding, training, and expertise to help them expand. The annual cohort program focuses on establishing “capital-efficient and scalable-technology startups” in the Internet, software, mobile, gaming, and e-commerce industries. Startups chosen from hundreds of applications receive a $25,000 seed investment, training, and office space in exchange for a 3 percent to 10% equity stake. Each firm can receive up to $300,000 in funding from Blue Startups.

16. NFX —NFX is a pre-seed and seed stage investor that is revolutionizing the way true innovators get financed. They believe that recognizing what others don’t see is the first step toward producing something truly meaningful. With this approach, they redefined industries as founders. As investors, they take a similar strategy. The Founder’s eyes are always there in the NFX lens. The firm’s strategy is to first create a software-powered early-stage experience for all Founders. Second, they reintroduced exponential but little-known tactics for network effects and growth to bring the founders back. Third, to make the commonly seen ways of technology’s most influential companies visible. They’re entrepreneurs first because they’re entrepreneurs first, having founded ten firms with more than $10 billion in exits across numerous industries and regions. They’re also hell-bent on protecting the backs of the next generation of brave founders.

17. SixThirty Ventures —SixThirty Ventures is a global venture financing firm that focuses on late-stage FinTech, InsurTech, and Cyber Security startups. SixThirty has raised a total of $2 million in two rounds of investment. Their most recent funding came from a Seed round on October 11, 2016. SixThirty has raised $38.9 million across four funds, the most recent of which being the SixThirty Cyber Fund. This fund was launched on May 17, 2019 and raised $3.9 million in total.

18. Capital Innovators — Capital Innovators is a Saint Louis-based accelerator that was founded in 2011. The company administers an accelerator program that offers seed financing, mentorship, resources, and connections.

19. MuckerLab —MuckerLab is a Series A and B startup.Incubation, pre-seed, seed, startup, and early-stage investments are the focus of this venture capital business. Mucker Capital has raised $150 million in three funds, with Mucker IV being the most recent. On February 15, 2018, this fund was announced, and it raised $85 million. Mucker Capital has made 203 investments. Their most recent investment was in OK Capsule, which raised $9.5 million on March 23, 2022. Mucker Capital has put money into 54 different companies. On March 16, 2022, Bambee raised $30 million in their most recent diversity investment. Mucker Capital has experienced 17 exits. Mucker Capital’s most notable exits include Rocksbox, Bridg, and Emailage.