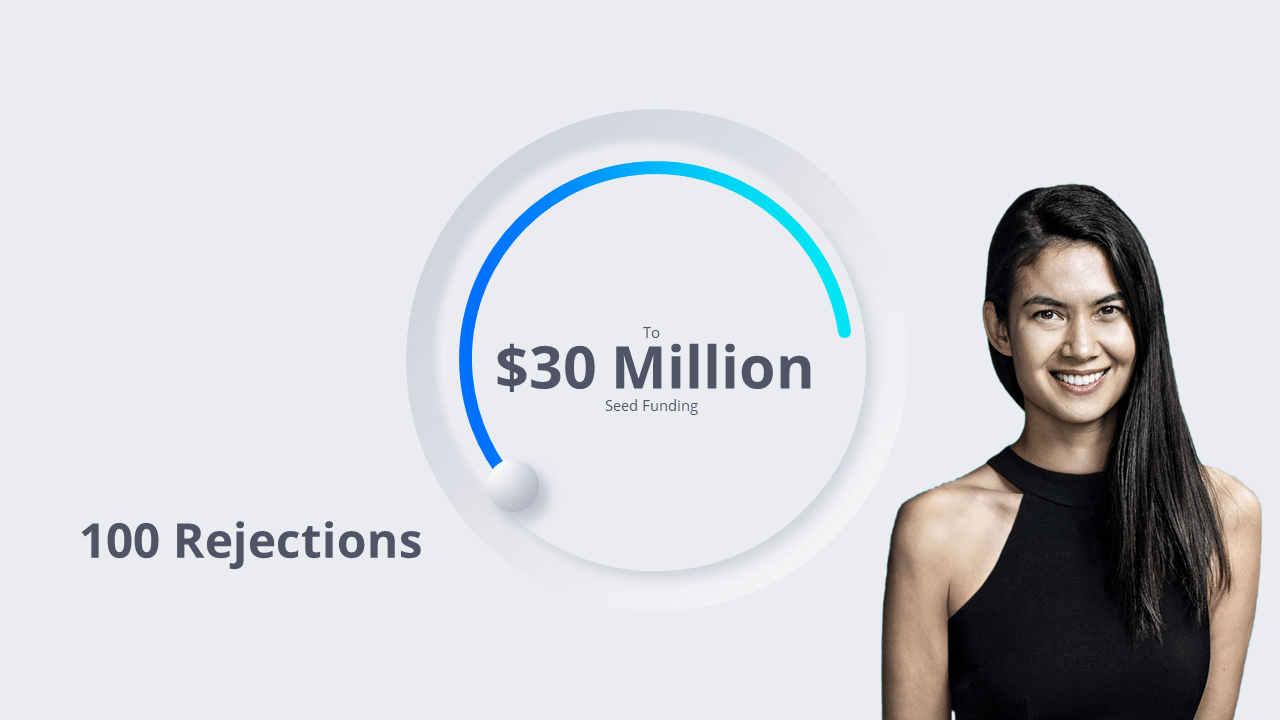

100 failed attempts of fundraising to 40B$ company.

“How to manage money, invest it, and make business decisions are typically considered to involve a lot of mathematical calculations, where data and formulae tell us exactly what to do. But in the real world, people don’t make decisions

on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your unique view of the world, ego, pride, marketing, and odd incentives are scrambled together”

— MORGAN HOUSEL author Psychology of Money.

As someone from outside, we are bound to think that investors are very smart and rational people and they know the exact formula for which startup to invest

in.

But this is only the half-truth.

Of course, they have some basic checkpoints to evaluate whether to fund an idea or not but beyond that, they are still humans.

No startup founder who has raised in the past

can give you an exact formula on what worked for them and assure you that it will work for you as well.

The simple answer is that you are different, your team is different, which makes your way of doing business and achieving things differently.

A typical fundraising process can take 3 to 12 months in some cases even more than that. Fundraising can take a lot of time and energy. The best thing you can do as an entrepreneur is to be prepared as much as possible.

So, is it just the hit and trial process? Where one fine day someone will see value in what you are building?

The bad news is that beyond the standard pitch deck, there is no one fit-for-all solution that will

get you funding.

Though I would say it is a blessing in disguise.

Even though there may not be one fit-for-all solution, there is still definitely a process that can be followed to find things that will matter

beyond the ordinary pitch deck format and solution and will only be relevant to your startup, which can save your time and the number of rejections.

But before digging deep into the process let us first understand what is it that matters and how irrational behaviors are influenced.

Understanding the irrational bias behind the rational-looking decisions.

So, here is the catch: you have a great idea, you have a proven business model, MVP (even better). But is it enough for an investor to be willing to spend a valuable 15 minutes on you and agree to lend you money and 4- 5 (or

more) years of time and trust?

Certainly not.

But what can we do apart from this? Is there any magic formula that will work?

Because it leaves room for experimentation and innovation, all ideas and startups

cannot be funded with a perfect 13 slide problem solution deck but also at the time not all ideas will be rejected for imperfect decks.

So perfect or imperfect, what is that one thing which can get us funded?

I would say it is excitement.

Can you create excitement about your idea followed by fear of missing out? Can you create excitement about the journey you are going to take people on for the next 10 to 15 years?

Create an excitement and hesitation chart or download it from here.

Once your unique pitch deck is ready, start practicing delivering your pitch to your friends and family.

Can a person totally irrelevant from your field of business understand each slide without you needing to explain it. Is it so simple that even your grandma can understand it?

Give them this excitement and hesitation chart and deliver your pitch. Ask them to write down the most exciting part of your pitch in the excitement section and the part which makes them feel uncomfortable less engaging in the hesitations part. I often ask my clients to do this exercise for a few days and they are always shocked about what other people find interesting and vice- versa.

3. Repeat this same exercise in a larger circle, maybe this time your colleagues or the investors you are not so serious about.

Keep refining until you get the very best deal for your hard work and dream.

An ideal pitch creation process would look like.

this one is the easiest to say and the hardest to do. When you make a pitch, you have to give the investor a prepared dish, and not ingredients. What this actually means is that while you need to have all the ingredients, like the

problem slide, the solution slide, the revenue slide, and so on and so forth, you need to be able to present them in a way that the entire pitch can be broken down into few parts and each of these parts tells an individual story.

Basically, creating story arcs of 4–5 slides and sequencing these story arcs is what will make a pitch.

For example: “I experienced the pain first-hand, then I saw more people that face the same problem. So, we built a solution, and here’s how the product works!”- This entire can be one story arc.

Similarly, the next arc can be “We launched the product, it’s working, the engagement is high, these are the markets we’re addressing, with a huge market opportunity”

Entrepreneurs are really good at talking about the execution level. They have to make a new product, hire new people, etc, every day, every week. So, they are really good at execution. Good entrepreneurs can ramp it up a level and talk about the company vision as well. So, you know what to execute, you know why you have opened the company. But most entrepreneurs are not able to target the top stage, i.e., how the world is changing. But the investors live at this level. Unlike entrepreneurs, they do not make products daily. Instead, they meet new people every day, they understand how the world is changing and how this will create different opportunities. So, now how if you ask yourself certain questions like “Why is now the only time this company could be built?” then you can streamline your thought process on why this company would not work 5 years before or 5 years down the line!

Most entrepreneurs think that investors are smart. They follow logic while investing etc. But as a fact, most investors lose money on investing in a company at the seed stage or A series. Mostly, they look for excitement. So how do you figure out what is exciting about your company? To understand this, you can use a small exercise. When you practice your pitch in front of people who can tell you what are your weaknesses, ask them to note down on a piece of paper, what about your pitch gets them excited, and similarly, what sparks their hesitation. Like this, after 5 to 10 different practice pitches, you can figure out the common 3–4 things that get people excited, and similarly the things that people hesitate about. So now, you can make sure that the things that people are excited about are expressed early and very clearly in the pitch, such that you can tell a great, focused story about those. But you need to deal with the hesitations because they will remain in people’s heads when they’re listening to you.

As a startup, credibility does not set you apart from anyone. More than credible, you want to be unique and special. Basically, don’t stay general or vague. Be specific. This will make people remember you

Whenever you add a lot of stuff to your pitch, it distracts people from the most important parts. Cut everything that distracts from your pitch.